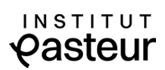

In France, the tax authorities encourage donations by individuals and companies by enabling them to claim a tax deduction on donations to charitable organizations and foundations.

For individuals

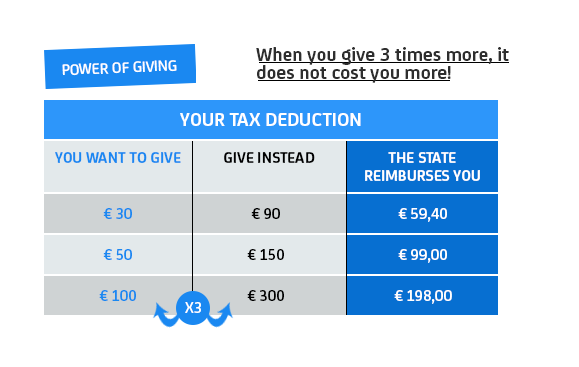

You can enjoy a tax reduction of 66% of the amount you donate, up to a maximum of 20% of your taxable income. If you exceed this limit, you can carry forward the excess amount over the next five years. In practice, this mechanism allows you to choose to allocate some of your taxes to medical research by making a donation.

Find out about the special provisions for donations that are deductible from the ISF (the solidarity tax on wealth) in aid of the Institut Pasteur's research.

I've made donations to the Institut Pasteur. How can I prove it?

However you choose to make your donation, the Institut Pasteur will send you a certificate known as a tax receipt that you can use to declare your donation to the tax authorities.

- If you make a one-off donation, your tax receipt will be sent no more than two weeks later, by second-class mail to avoid any unnecessary expense. It can also be directly downloaded from your Donor Space.

- If you support the Institut Pasteur with a regular donation or direct debit, you will be sent an overall tax receipt during the first quarter of the following year in time to fill out your tax return.

How can I claim tax relief on my donations to the Institut Pasteur?

Inscrivez le montant global de vos dons annuels au profit de l’Institut Pasteur, ou à l’ensemble des associations que vous soutenez, dans la case UF lors de votre déclaration d’impôt sur le revenu.

For companies

Companies can enjoy a corporate tax reduction of 60% of their donations, up to a maximum of 0.5‰ of their annual turnover.If you exceed this limit, you can carry over the excess for the payment of taxes due in the next five financial years. You can even carry a loss year over.

Companies subject to income tax enjoy the same tax benefit.

This tax reduction mechanism applies to cash donations, in-kind donations (gifts of movable property or shares, for example) as well as skill-based sponsorship.

This attractive tax system also governs the level of benefits that may be enjoyed in return for the donation: the benefits must not exceed 25% of the value of the donation.